Ficha técnica

| 🗓️ Last update | 1 month ago |

Más información

The platform is designed to educate users about the importance of insurance, simplify processes and improve customer experience with 24/7 support and online management of all policies.

Key Features

1. Insurance Comparison: Users can compare policies from various insurers to choose the one that best suits their needs and budget.

2. Personalized Advice: Digital and human advisors available to guide clients in selecting insurance appropriate to their personal circumstances.

3. Policy Simulator: Interactive tool that allows users to calculate the cost of their policies based on their profile and specific needs.

4. Policy Management: Personalized portal where users can manage all their policies in one place, from renewals to claims.

5. Financial Education: Articles, guides and videos on the importance of insurance, how to choose the right one, and other financial topics related to asset protection and health.

6. 100% Digital Process: Users can acquire, renew and cancel policies directly from the platform without the need for physical interactions.

7. Mobile Application: An app that allows policy management, expiration alerts, and direct support from your mobile phone.

Target Audience

1. Individuals: Individuals seeking personal insurance (life, health, auto, home).

2. Small Businesses: Solutions tailored to protect the assets and employees of small and medium-sized businesses.

3. Millennials and Generation Z: Focused on a young, digitally aware audience that seeks quick and accessible solutions online.

Revenue Model

1. Sales Commissions: The platform receives a commission for each policy sold.

2. Premium Subscription: Access to exclusive services such as personalized advice and automatic alerts for renewals and expirations.

3. Targeted Advertising: Insurers can pay to highlight their products on the platform.

Marketing Strategy

1. SEO and Content Marketing: Educational blog on insurance and personal finance topics.

2. Social Networks: Campaigns focused on the importance of financial protection for various generations.

3. Partnerships: Alliances with financial institutions and insurance companies to offer discounts or exclusive promotions.

4. Advertising on Google and Facebook: Paid advertising on search engines and social networks to attract qualified traffic.

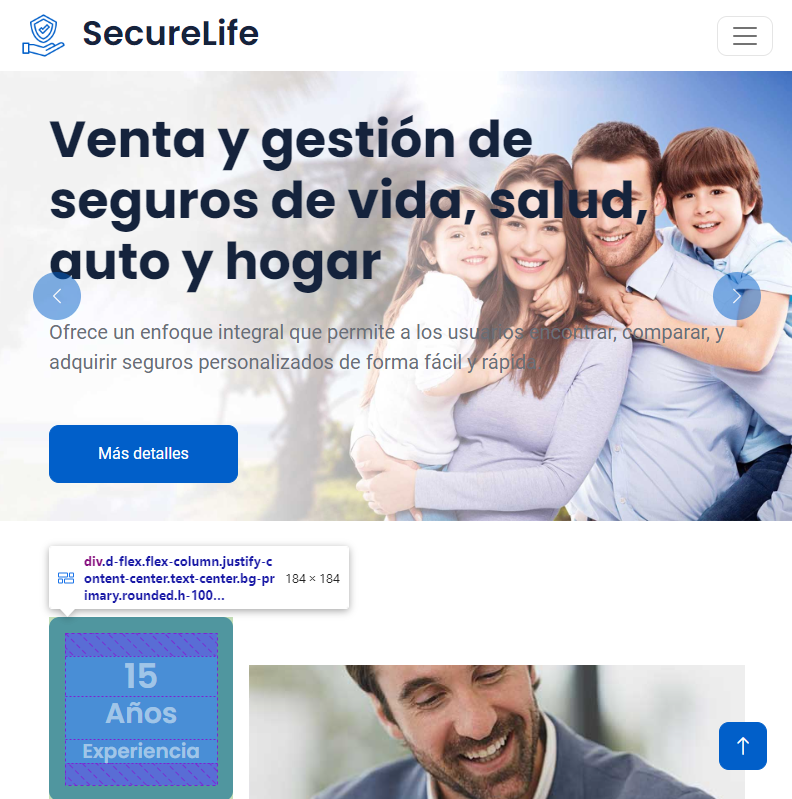

SecureLife

Referencia: #SecureLife

🔖Condición: Prototipo Digital

It is a digital platform dedicated to the sale and management of life, health, auto and home insurance. It offers a comprehensive approach that allows users to find, compare and purchase personalized insurance quickly and easily.